An accounting firm CRM (Customer Relationship Management) is a software tool designed specifically to help accounting firms manage their client relationships and interactions. It provides a centralized platform for tracking client data, managing communication, and automating workflows.

Using an accounting firm CRM offers several benefits, including improved client satisfaction, increased efficiency, and enhanced profitability. By providing a complete view of each client’s history, preferences, and interactions, accounting firms can offer personalized and proactive service. This leads to stronger client relationships and increased client retention. Additionally, by automating tasks such as scheduling appointments, sending reminders, and generating reports, accounting firms can save time and improve their overall efficiency.

The implementation of accounting firm CRMs has evolved over time. In the past, accounting firms relied on manual processes and spreadsheets to manage client data. However, as technology has advanced, accounting firm CRMs have become more sophisticated and user-friendly. Today, many accounting firms use cloud-based CRMs that offer a wide range of features and integrations, allowing them to streamline their operations and improve their service to clients.

Accounting Firm CRM

An accounting firm CRM is a vital tool for managing client relationships and interactions. It provides a centralized platform for tracking client data, managing communication, and automating workflows. Key aspects of accounting firm CRMs include:

- Client Management: Track client data, preferences, and interactions in one place.

- Communication Management: Manage communication with clients through email, phone, and other channels.

- Workflow Automation: Automate tasks such as scheduling appointments, sending reminders, and generating reports.

- Data Analysis: Analyze client data to identify trends and improve service.

- Integration: Integrate with other accounting software and applications.

- Security: Protect client data with robust security measures.

- Cloud-Based: Access your CRM from anywhere with an internet connection.

- Mobile Access: Manage client relationships on the go with mobile access.

By implementing an accounting firm CRM, firms can improve client satisfaction, increase efficiency, and enhance profitability. For example, by tracking client communication and preferences, firms can provide personalized and proactive service. By automating tasks, firms can save time and focus on more strategic initiatives. And by analyzing client data, firms can identify opportunities to improve their service offerings.

Client Management

Client management is a critical component of any accounting firm CRM. By tracking client data, preferences, and interactions in one place, accounting firms can gain a complete view of each client’s needs and provide personalized and proactive service.

For example, an accounting firm CRM can track client communication, including emails, phone calls, and meetings. This information can be used to identify trends and patterns in client behavior. By understanding client preferences, accounting firms can tailor their services to meet the specific needs of each client. Additionally, by tracking client interactions, accounting firms can identify opportunities to improve their service offerings.

In summary, client management is essential for accounting firms to provide excellent service to their clients. By tracking client data, preferences, and interactions in one place, accounting firms can gain a complete view of each client’s needs and provide personalized and proactive service.

Communication Management

In the context of accounting firm CRM, communication management is essential for building and maintaining strong client relationships. By managing communication through email, phone, and other channels, accounting firms can ensure that clients receive timely and accurate information about their financial matters.

- Centralized Communication: Accounting firm CRMs provide a centralized platform for managing all client communication. This eliminates the need for multiple communication channels, reducing the risk of miscommunication and ensuring that all client interactions are documented in one place.

- Personalized Communication: Accounting firm CRMs allow firms to personalize communication based on client preferences. For example, firms can set up automated email campaigns to send clients reminders about upcoming appointments or deadlines. Firms can also use CRMs to track client communication history, so that they can quickly and easily reference previous conversations.

- Proactive Communication: Accounting firm CRMs can be used to proactively communicate with clients. For example, firms can use CRMs to send clients updates on tax law changes or to offer financial planning advice. Proactive communication helps to build trust and rapport with clients, and it can also help to identify and address potential issues before they become major problems.

- Improved Collaboration: Accounting firm CRMs can improve collaboration between accountants and clients. By providing a shared platform for communication, accountants and clients can easily share documents, ask questions, and track the progress of projects. Improved collaboration leads to better decision-making and more efficient outcomes.

Overall, communication management is a critical component of accounting firm CRM. By managing communication through email, phone, and other channels, accounting firms can build and maintain strong client relationships, provide timely and accurate information, and improve collaboration.

Workflow Automation

Workflow automation is a critical component of accounting firm CRM, as it allows firms to automate repetitive and time-consuming tasks, such as scheduling appointments, sending reminders, and generating reports. This can free up accountants’ time, allowing them to focus on more strategic initiatives, such as providing advisory services to clients.

- Improved Efficiency: By automating tasks, accounting firms can save time and improve their overall efficiency. For example, an accounting firm CRM can be used to automatically schedule appointments, send reminders, and generate reports. This can free up accountants’ time, allowing them to focus on more strategic initiatives.

- Enhanced Accuracy: Workflow automation can also help to improve the accuracy of accounting tasks. For example, an accounting firm CRM can be used to generate reports that are automatically populated with data from the firm’s accounting system. This can help to reduce the risk of errors and ensure that reports are accurate and reliable.

- Improved Client Service: Workflow automation can also help to improve client service. For example, an accounting firm CRM can be used to send automated reminders to clients about upcoming appointments or deadlines. This can help to ensure that clients are kept informed and that their needs are met in a timely manner.

- Increased Revenue: Workflow automation can also help to increase revenue. For example, an accounting firm CRM can be used to track client interactions and identify opportunities for cross-selling and up-selling. This can help to increase the firm’s revenue and profitability.

Overall, workflow automation is a critical component of accounting firm CRM. By automating repetitive and time-consuming tasks, accounting firms can save time, improve accuracy, enhance client service, and increase revenue.

Data Analysis

Data analysis is a critical component of accounting firm CRM. By analyzing client data, accounting firms can identify trends and patterns that can be used to improve service delivery. For example, an accounting firm might analyze client data to identify common pain points or areas where clients need additional support. This information can then be used to develop new services or improve existing ones.

In addition to identifying trends, data analysis can also be used to measure the effectiveness of marketing campaigns and other initiatives. By tracking key metrics, such as website traffic and conversion rates, accounting firms can determine what is working and what is not. This information can then be used to make adjustments and improve the overall effectiveness of marketing efforts.

Overall, data analysis is a powerful tool that can be used to improve the efficiency and effectiveness of accounting firm CRM. By analyzing client data, accounting firms can identify trends, measure the effectiveness of marketing campaigns, and make informed decisions about how to improve service delivery.

Integration

Integration is a critical component of accounting firm CRM, as it allows firms to connect their CRM with other accounting software and applications. This can provide a number of benefits, including:

- Improved efficiency: By integrating their CRM with other accounting software, firms can automate tasks such as data entry and reporting. This can free up accountants’ time, allowing them to focus on more strategic initiatives.

- Enhanced accuracy: Integration can also help to improve the accuracy of accounting data. For example, by integrating their CRM with their accounting system, firms can ensure that client data is automatically updated in both systems. This can help to reduce the risk of errors and ensure that financial reports are accurate and reliable.

- Improved client service: Integration can also help to improve client service. For example, by integrating their CRM with their client portal, firms can provide clients with easy access to their account information and other resources. This can help to build trust and rapport with clients, and it can also help to identify and address client needs in a timely manner.

In addition to the benefits listed above, integration can also help accounting firms to:

- Increase revenue: By integrating their CRM with other business applications, firms can gain a complete view of their clients’ needs. This can help firms to identify opportunities for cross-selling and up-selling, which can lead to increased revenue.

- Improve compliance: Integration can also help accounting firms to improve compliance with regulatory requirements. For example, by integrating their CRM with their document management system, firms can ensure that all client documents are properly stored and managed.

Overall, integration is a critical component of accounting firm CRM. By integrating their CRM with other accounting software and applications, firms can improve efficiency, accuracy, client service, revenue, and compliance.

Security

In the context of accounting firm CRM, security is paramount. Accounting firms handle sensitive client data, including financial information, tax returns, and personal identification numbers. It is essential that this data be protected from unauthorized access, both internally and externally.

- Encryption: Encryption is a critical security measure that can be used to protect client data both at rest and in transit. By encrypting data, accounting firms can make it unreadable to unauthorized users, even if they gain access to it.

- Authentication and Authorization: Authentication and authorization are two important security measures that can be used to control access to client data. Authentication verifies the identity of a user, while authorization determines what actions that user is allowed to perform. By implementing strong authentication and authorization measures, accounting firms can help to prevent unauthorized access to client data.

- Data Backup and Recovery: Data backup and recovery are essential for protecting client data in the event of a disaster. By backing up data regularly and storing it in a secure location, accounting firms can ensure that they can recover client data in the event of a hardware failure, natural disaster, or other emergency.

- Security Audits: Regular security audits can help accounting firms to identify and address security vulnerabilities. By conducting regular security audits, accounting firms can help to ensure that their systems are secure and that client data is protected.

By implementing robust security measures, accounting firms can protect client data from unauthorized access and ensure that it remains confidential and secure.

Cloud-Based

For accounting firms, having a cloud-based CRM is essential for providing efficient and effective client service. Cloud-based CRMs offer a number of benefits over traditional on-premise CRMs, including:

- Accessibility: Cloud-based CRMs can be accessed from anywhere with an internet connection. This means that accounting firms can access their CRM data and manage client relationships from anywhere, at any time.

- Mobility: Cloud-based CRMs are mobile-friendly, which means that accounting firms can access their CRM data and manage client relationships on the go. This is especially important for accounting firms that have employees who work remotely or who travel frequently.

- Scalability: Cloud-based CRMs are scalable, which means that they can be easily adjusted to meet the changing needs of accounting firms. As an accounting firm grows, its CRM can be scaled up to accommodate more users and data.

- Security: Cloud-based CRMs are secure, and accounting firms can be confident that their client data is safe and protected.

In addition to the benefits listed above, cloud-based CRMs can also help accounting firms to improve collaboration and communication. By having a centralized platform for managing client relationships, accounting firms can ensure that everyone in the firm has access to the same information. This can help to improve communication and collaboration, and it can also help to ensure that clients are receiving consistent service from all members of the firm.

Overall, cloud-based CRMs offer a number of benefits for accounting firms. By implementing a cloud-based CRM, accounting firms can improve accessibility, mobility, scalability, security, collaboration, and communication.

Mobile Access

In today’s fast-paced business environment, it is more important than ever for accounting firms to be able to manage client relationships on the go. Mobile access to accounting firm CRM systems makes this possible, allowing accountants to access client data, track interactions, and manage tasks from anywhere, at any time.

There are many benefits to mobile access for accounting firms. First, it improves efficiency by allowing accountants to work from anywhere. This can be especially helpful for accountants who travel frequently or who work with clients in different time zones. Second, mobile access improves communication by allowing accountants to respond to client inquiries and requests in a timely manner. This can help to build stronger relationships with clients and increase client satisfaction. Third, mobile access can help to improve collaboration by allowing accountants to share information and work together on projects from anywhere. This can help to streamline workflows and improve the overall efficiency of the accounting firm.

In addition to the benefits listed above, mobile access to accounting firm CRM systems can also help to improve security. By using a mobile device management (MDM) solution, accounting firms can enforce security policies on all mobile devices that access the CRM system. This can help to protect client data from unauthorized access and ensure that the CRM system is used in a secure manner.

Overall, mobile access is an essential component of accounting firm CRM systems. By providing accountants with the ability to manage client relationships on the go, accounting firms can improve efficiency, communication, collaboration, and security.

FAQs on “accounting firm CRM”

This section addresses frequently asked questions about accounting firm CRM. Read on to learn more about how CRM can benefit your accounting firm.

Question 1: What are the benefits of using an accounting firm CRM?

Accounting firm CRMs offer numerous benefits, including improved client management, enhanced communication and collaboration, automated workflows, data-driven insights, seamless integration, robust security, and increased mobility.

Question 2: How can accounting firms choose the right CRM?

When selecting a CRM, accounting firms should consider their specific needs and requirements. Factors to evaluate include the firm’s size, industry focus, budget, and desired features. It is advisable to conduct thorough research, consult with industry experts, and request demos to make an informed decision.

Question 3: How does a CRM improve client management for accounting firms?

CRMs centralize client data, making it easily accessible and organized. This enables accounting firms to track client interactions, preferences, and communication history in one place. With a comprehensive view of each client’s profile, firms can provide personalized and proactive service, leading to stronger client relationships and increased satisfaction.

Question 4: How can accounting firms leverage CRM for better communication and collaboration?

CRMs facilitate seamless communication between accountants, clients, and team members. They offer centralized platforms for managing emails, phone calls, and messages, ensuring that all client interactions are tracked and easily accessible. Additionally, CRMs enable document sharing, task assignment, and real-time collaboration, enhancing teamwork and streamlining workflows.

Question 5: How does CRM help accounting firms automate workflows?

CRMs automate repetitive tasks such as appointment scheduling, reminder notifications, and report generation. By streamlining these processes, accounting firms save time and resources, allowing them to focus on more strategic initiatives that drive growth and client satisfaction.

Question 6: How can accounting firms gain data-driven insights from their CRM?

CRMs provide valuable data and analytics that can help accounting firms make informed decisions. By analyzing client interactions, preferences, and feedback, firms can identify areas for improvement, optimize their services, and tailor their marketing campaigns to better meet the needs of their clients.

In summary, accounting firm CRMs offer a comprehensive solution for managing client relationships, enhancing communication and collaboration, automating workflows, and gaining data-driven insights. By leveraging these capabilities, accounting firms can streamline their operations, improve client service, and drive business growth.

For more information on accounting firm CRM, visit our website or contact us directly.

Tips for Choosing the Right Accounting Firm CRM

Selecting the right accounting firm CRM is crucial for optimizing client relationships and streamlining operations. Here are some tips to guide your decision-making process:

Tip 1: Define Your Needs and Goals

Start by clearly identifying your firm’s specific requirements. Consider the size of your firm, the services you offer, and your target clientele. Determine the key objectives you aim to achieve with a CRM, such as improving client communication, automating workflows, or enhancing data analysis.

Tip 2: Research and Compare Different Options

Explore the market to identify CRM solutions that cater specifically to accounting firms. Compare their features, pricing, and customer support offerings. Read reviews and testimonials from other firms to gain insights into their experiences.

Tip 3: Seek Expert Advice and Referrals

Consult with industry experts, such as accountants or technology consultants, who can provide valuable recommendations based on their knowledge and experience. Ask for referrals from other accounting firms that have successfully implemented CRM solutions.

Tip 4: Consider Integration Capabilities

Choose a CRM that seamlessly integrates with your existing accounting software and other business applications. This will ensure a smooth flow of data and eliminate the need for manual data entry, saving time and reducing errors.

Tip 5: Prioritize Data Security and Privacy

Ensure that the CRM you select meets industry standards for data security and privacy. Look for features such as encryption, access controls, and regular security audits to protect sensitive client information.

Tip 6: Focus on User Adoption and Training

Choose a CRM that is user-friendly and easy to adopt for your team. Provide comprehensive training and support to ensure that your employees can leverage the CRM’s full potential and maximize its benefits.

Tip 7: Evaluate Customer Support and Resources

Select a CRM vendor that offers reliable and responsive customer support. Consider the availability of documentation, online resources, and training materials to ensure that you have adequate support throughout your CRM implementation and usage.

By following these tips, accounting firms can make informed decisions when choosing the right CRM solution that aligns with their unique needs and drives operational efficiency, client satisfaction, and business growth.

Conclusion

In the competitive landscape of the accounting industry, leveraging a robust CRM solution is paramount for firms seeking to thrive. Accounting firm CRMs empower firms to centralize client data, enhance communication, automate workflows, and derive valuable insights to optimize client relationships and drive business growth.

By embracing the capabilities of accounting firm CRMs, firms can streamline operations, enhance efficiency, and deliver exceptional client service. The adoption of a CRM tailored to the specific needs of an accounting firm can serve as a catalyst for improved profitability, increased client satisfaction, and a competitive edge in the market. Investing in a CRM is not merely a technological upgrade but a strategic investment in the future success of an accounting firm.

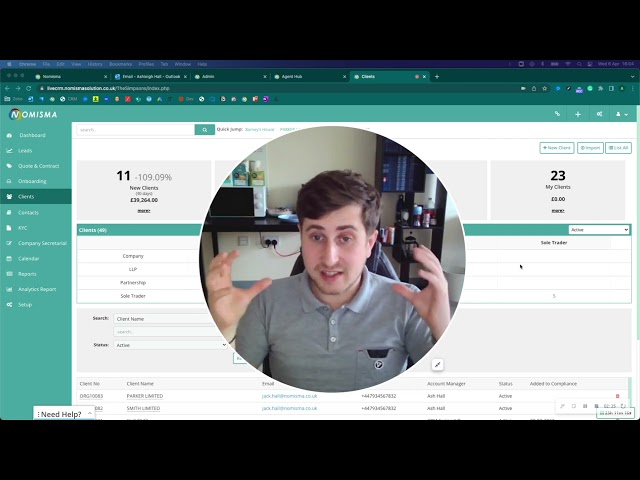

Youtube Video: